As President Donald Trump’s newly enacted “Big, Beautiful Bill” delivers sweeping tax reductions, particularly for America’s highest earners, the typical class of wealthy liberals has begun to come out of the woodwork to complain that they’re just too rich to deserve a tax cut.

Multimillionaire Kimberly Hoover, whose real estate empire stretches from Manhattan to Miami and Quebec, is among those speaking out. “At some point, it starts to feel wrong. It starts to feel excessive. It starts to feel somehow inappropriate,” she told The Washington Post while attending a sapphic literature conference in Albany. “And at some point, it just doesn’t feel good.” Though Hoover stands to save several million dollars under the new law, signed on July 4, 2025, she actively lobbied against it. “Imbalanced is really not good for anyone, even if you’re on the positive end of that imbalance, because it’s unsustainable,” she said.

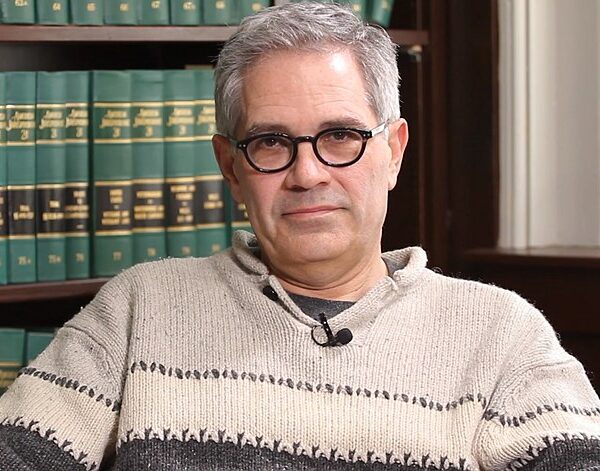

For Drew E. Pomerance, a Los Angeles attorney worth tens of millions, the math is equally troubling. He saved tens of thousands saved annually from Trump cutting taxes for everyone. “Don’t get me wrong: I like money. I like having money. I’m not opposed to having money,” he said. “But at the expense of what it does to the rest of the country, it should not be a priority to give me and other rich people more money.”

Former BlackRock executive Morris Pearl, a prominent member of the progressive group Patriotic Millionaires, echoed that sentiment. While the estate tax rollback and Opportunity Zone incentives are lucrative for him, he’s uneasy about the broader consequences. “It’s great for me personally, financially,” Pearl admitted to Wapo. “But even looking at my own and my family’s long-term self-interest, I would prefer less inequality and less of a country of very rich and very poor, and more of a country with lots of people doing all right.”

Even within elite financial advising circles, the ambivalence is palpable. “The general mentality is the same across the board with my clients: ‘I want to pay the least I can. I also want the best for my country, and I would invert the two if it had a meaningful impact,’” said Steve Lockshin, who advises ultra-high-net-worth individuals. Many of them, he noted, are uneasy about saving “hundreds of thousands, if not millions” while watching national priorities falter.

Fortunately, these high-net-worth progressives now have a direct way to put their convictions into action—using nothing more than an iPhone. Americans can now send money directly to the U.S. Treasury via Venmo or PayPal to help reduce the national debt, thanks to a recently updated payment system. The Treasury Department’s obscure “Gifts to Reduce the Public Debt” program—in existence since 1996—went viral after NPR’s Jack Corbett shared a screenshot showing its modernized interface. Since its inception, the program has collected $67.3 million, a sum Axios noted equals just 20 minutes of new federal debt.

you can venmo the United States to help pay off the national debt pic.twitter.com/UBfSvbAIx0

— Jack Corbett (@jackcorrbit) July 23, 2025

With the U.S. national debt surpassing $36.7 trillion—and projected to climb another $3.4 trillion over the next decade—the Treasury’s Pay.gov platform offers a solution: if you oppose Trump’s tax cuts, send the money back.

Isn’t that what moral consistency demands?

Whether Hoover, Pomerance, or other progressive millionaires will actually part with their windfalls remains unclear. But thanks to modern payment apps, the option is now just a tap away.

[Read More: Indictments Loom For Obama Crew]